Unlocking the World of Forex Trading Investment Strategies and Insights

Forex trading investment has become a popular choice for individuals looking to capitalize on the fluid nature of international currency markets. The potential for high returns and the accessibility of the forex market have drawn millions to explore this exciting financial avenue. However, it’s essential to approach forex trading with the right knowledge and strategies in order to navigate its complexities effectively. This guide offers valuable insights and practical tips for both novice and experienced traders to enhance their forex trading investment journey. For those interested in Islamic finance, consider checking out forex trading investment Best Islamic Trading, which offers specialized services in compliance with Islamic principles.

Understanding Forex Trading

Forex, short for foreign exchange, is the process of converting one currency into another for various purposes, typically for trade, tourism, or business. Unlike other financial markets, the forex market operates 24 hours a day, five days a week, making it one of the most liquid markets in the world. This constant activity provides opportunities for traders to capitalize on price fluctuations across different currencies.

Why Invest in Forex?

There are several compelling reasons why investors are drawn to forex trading, including:

- High Liquidity: The forex market is the largest financial market in the world, with trillions of dollars traded each day, ensuring high liquidity and the ability to enter and exit trades at will.

- Leverage: Forex trading often allows traders to control larger positions than their initial investment through leverage, which can amplify potential profits (and potential losses).

- Diverse Opportunities: Traders can speculate on the value of currencies against one another, creating a wide array of opportunities to profit from both rising and falling markets.

- Accessibility: With the advancement of technology and online trading platforms, forex trading has become accessible to anyone with an internet connection and a computer or smartphone.

Getting Started with Forex Trading Investment

For those interested in starting their forex journey, the following steps can help lay a solid foundation:

- Educate Yourself: Understanding the basics of forex trading is crucial. There are numerous resources available, including online courses, books, and webinars that cover key concepts like pips, lots, and candlestick patterns.

- Choose a Reliable Broker: Selecting the right forex broker is essential for your trading experience. Look for brokers that are regulated, offer competitive spreads, and provide a user-friendly trading platform.

- Open a Trading Account: After choosing a broker, you’ll need to open a trading account. Most brokers offer demo accounts where you can practice trading with virtual money before committing real capital.

- Develop a Trading Plan: A solid trading plan outlines your goals, risk tolerance, and strategies. It should include when to enter and exit trades, as well as how much capital to risk on each trade.

Key Forex Trading Strategies

There are various strategies traders employ to navigate the forex market. Here are some popular approaches:

- Scalping: This involves making small, quick trades to exploit minor price changes. Scalpers often make dozens or even hundreds of trades in a single day.

- Day Trading: Day traders open and close positions within the same day, aiming to profit from short-term price movements without exposure to overnight risks.

- Swing Trading: Swing traders hold positions for several days or weeks to capitalize on expected upward or downward market shifts.

- Position Trading: This longer-term strategy involves holding positions for months or years, relying on fundamental analysis to guide trading decisions.

Technical and Fundamental Analysis

Successful forex traders often utilize both technical and fundamental analysis to inform their trading decisions:

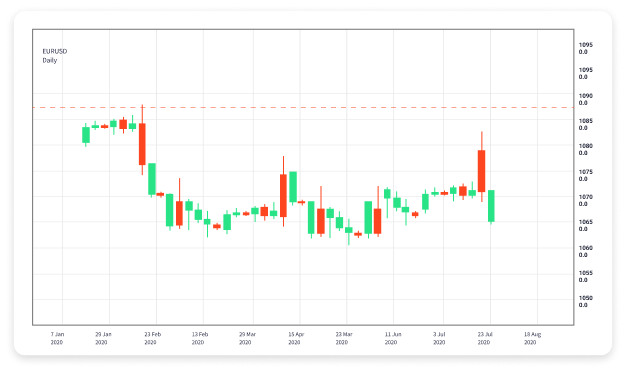

- Technical Analysis: This involves studying charts and using indicators to identify potential price movements. Traders analyze patterns, support and resistance levels, and trend lines to make predictions about future price action.

- Fundamental Analysis: This approach focuses on economic indicators, news events, and geopolitical factors that may impact currency values. Traders consider factors such as interest rates, inflation, and employment data to gauge economic health.

Risk Management in Forex Trading

Effective risk management is vital in forex trading. It’s essential to protect your capital while also allowing for potential gains. Here are some risk management strategies:

- Use Stop-Loss Orders: These orders automatically close a trade at a predetermined price, limiting potential losses.

- Limit Leverage: While leverage can amplify profits, it can also increase losses. Trading with lower leverage can reduce risk exposure.

- Diversify Trades: Avoid putting all your capital into one trade or currency pair. Diversification can help reduce overall risk.

- Only Risk a Small Percentage: Many professional traders recommend risking no more than 1-2% of your trading capital on a single trade.

Final Thoughts

Forex trading investment offers exciting opportunities for those willing to undertake the necessary research and education. By understanding how the market works, developing a robust trading plan, and implementing effective risk management, traders can enhance their chances of achieving long-term success. As with any investment, it is crucial to remain disciplined and continuously refine your strategies as you gain more experience. Always stay informed about market conditions and keep learning, as the forex landscape is constantly evolving.