Exploring the World of Online Forex Trading 1795443985

Forex trading online has become increasingly popular due to its accessibility and the potential for significant returns. As one of the most liquid and traded markets in the world, Forex offers both opportunities and challenges for traders. To navigate this complex landscape successfully, it’s essential to understand the fundamentals of Forex trading, the different trading strategies available, and how to utilize the right tools and platforms, such as trading forex online Jordan Brokers.

Understanding Forex Trading

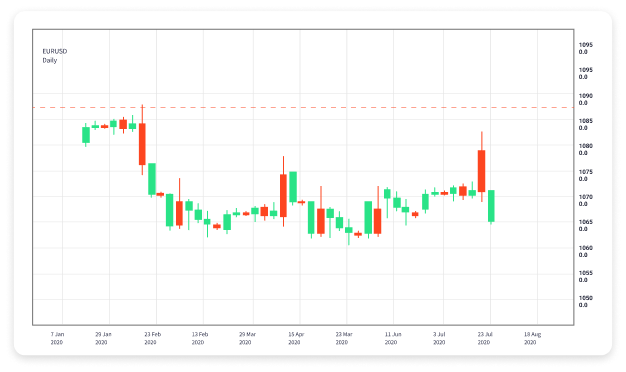

The Forex market is a decentralized global marketplace where currencies are exchanged. Trading in this market occurs 24 hours a day, five days a week, allowing traders to open and close positions at almost any time. The main objective of Forex trading is to profit from the changes in currency exchange rates. Traders speculate on the future movements of currency pairs, which consist of a base currency and a quote currency, for example, EUR/USD.

Key Concepts in Forex Trading

Before diving into Forex trading, it’s crucial to familiarize yourself with a few key concepts:

- Currency Pairs: Forex trading involves trading currency pairs. The first currency in the pair is the base currency, while the second is the quote currency. For instance, in the pair EUR/USD, EUR is the base currency, and USD is the quote currency.

- Pips: A pip, or “percentage in point,” is the smallest price move that a given exchange rate can make. For most currency pairs, this is usually the fourth decimal place.

- Leverage: Leverage allows traders to control larger positions in the market with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of substantial losses.

- Spread: The spread is the difference between the bid price and the ask price of a currency pair. It is essentially a transaction cost that traders incur when opening positions.

The Mechanics of Forex Trading

To start trading Forex, you’ll need to follow a few essential steps:

- Select a Forex Broker: Choosing a reliable broker is crucial for successful trading. Look for a broker that offers a user-friendly trading platform, competitive spreads, and excellent customer support.

- Create a Trading Account: After selecting a broker, you will need to create a trading account. Many brokers offer demo accounts where you can practice trading without risking real money.

- Fund Your Account: Once you are comfortable with your trading strategy, you will need to deposit funds into your trading account. Be sure to understand the funding options available through your broker.

- Choose a Trading Strategy: There are various trading strategies such as day trading, scalping, swing trading, and position trading. Each strategy has its own pros and cons, so choose one that aligns with your trading goals and risk tolerance.

- Analyze the Markets: Effective traders use both technical and fundamental analysis to make informed decisions. Understanding economic indicators, market sentiment, and price action can help identify potential trading opportunities.

- Execute Your Trades: Once you’ve done your analysis, execute your trades accordingly. Keep an eye on the market and adjust your positions as necessary to manage risk and lock in profits.

Essential Tools for Forex Trading

Several tools can aid in Forex trading, enhancing your analysis and decision-making abilities:

- Charting Software: Most brokers provide advanced charting tools that allow traders to visualize price movements and analyze trends.

- Economic Calendars: Economic calendars help traders stay informed about upcoming economic events that may impact the Forex market.

- Trading Signals: Some platforms offer trading signals based on algorithmic analysis or expert recommendations, providing additional insight into potential trades.

- Risk Management Tools: Using stop-loss orders and take-profit levels can help you manage your risk more effectively and protect your capital.

Common Mistakes to Avoid in Forex Trading

Forex trading can be rewarding, but many new traders fall into common traps that can lead to losses. Here are a few pitfalls to avoid:

- Lack of a Trading Plan: Entering the market without a solid trading plan can lead to impulsive decisions and emotional trading.

- Ignoring Risk Management: Many traders neglect to use proper risk management strategies, which can result in significant losses.

- Overleveraging: While leverage can increase potential profits, it also amplifies losses. It’s crucial to use leverage responsibly.

- Chasing Losses: Attempting to recover losses by increasing position sizes can lead to further losses and is a trap many traders fall into.

Conclusion

Forex trading online offers an exciting opportunity to participate in the global financial markets. However, success in Forex trading requires knowledge, discipline, and a well-defined strategy. By understanding the fundamentals of Forex trading, utilizing the right tools, and being aware of common pitfalls, traders can enhance their chances of achieving their financial goals. Whether you are new to Forex or an experienced trader, platforms like Jordan Brokers can provide essential resources and support to help you on your trading journey.